NVIDIA's Decline? Think Again. Annual Revenue Hits $947.2 Billion, Profit Reaches $528.4 Billion

![]() 02/27 2025

02/27 2025

![]() 374

374

Those closely following the AI industry will be aware of the persistent bearish sentiment towards NVIDIA that has emerged over the past year.

Critics argue that as global large AI models continue to advance, excess computing power has rendered NVIDIA's valuation logic obsolete.

Moreover, the inability to sell many of NVIDIA's chips to the Chinese market is said to have significantly impacted its revenue and profits.

Is this really the case? NVIDIA recently released its fiscal year 2024 financial report, revealing an annual revenue of $130.5 billion (approximately RMB 947.2 billion), a 114% increase year-on-year, and an annual net profit of $72.8 billion (approximately RMB 528.4 billion), a 145% increase year-on-year.

Another crucial data point stands out: the gross margin was 75%, an increase of 2.3%. The significance of this figure speaks for itself, particularly given the 75% gross margin, which is remarkably high. This might explain why NVIDIA's market capitalization exceeds $3.2 trillion.

Taking the most recent quarter as an example, despite the backdrop of Deepseek, NVIDIA's revenue remained robust at $39.3 billion (approximately RMB 285.2 billion), a 78% increase year-on-year and a 12% increase quarter-on-quarter. The net profit was $22 billion (approximately RMB 159.6 billion), an 80% increase year-on-year and a 14% increase quarter-on-quarter. These figures demonstrate that NVIDIA's revenue and profit continue to impress, maintaining strong growth momentum.

At least based on current trends, NVIDIA appears to be in good health with no signs of decline. Of course, it's possible that the impact of Deepseek has yet to be fully felt in this quarter.

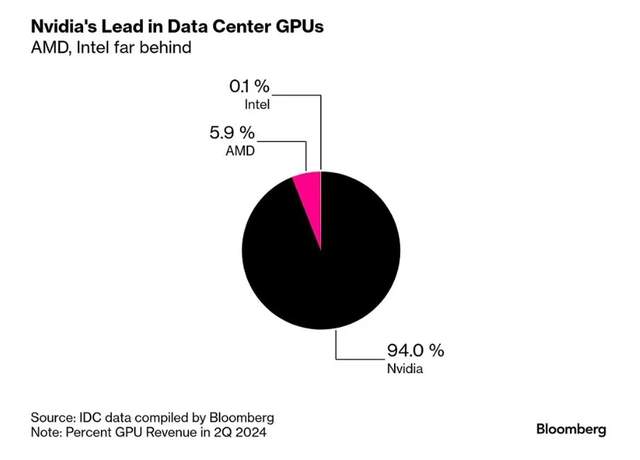

Furthermore, NVIDIA shared another compelling data point: in the data center market, NVIDIA holds a commanding 94% market share, while AMD accounts for only 5.9% and Intel a mere 0.1%. One wonders how Intel and AMD might feel upon seeing these statistics.

Additionally, despite the restriction on selling advanced chips to the Chinese market, NVIDIA's revenue in China reached $17.108 billion in fiscal year 2025, an all-time high and accounting for up to 13% of total revenue. This indicates that even with the H20, which has 80% of its performance limited, there remains a substantial market in China.

However, NVIDIA acknowledges that until regulatory conditions change, its data center business in China will continue to operate at a subpar level, far below normal capacity. In other words, NVIDIA believes it could sell more in China but is currently constrained.

Will Deepseek have a profound impact on the entire AI industry? Only time will tell, and we'll have to await NVIDIA's next quarterly report for further insights.